21 Moorfields

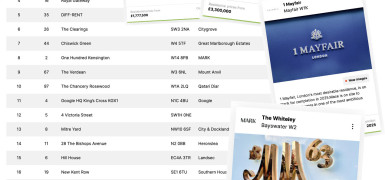

Key Details

Overview

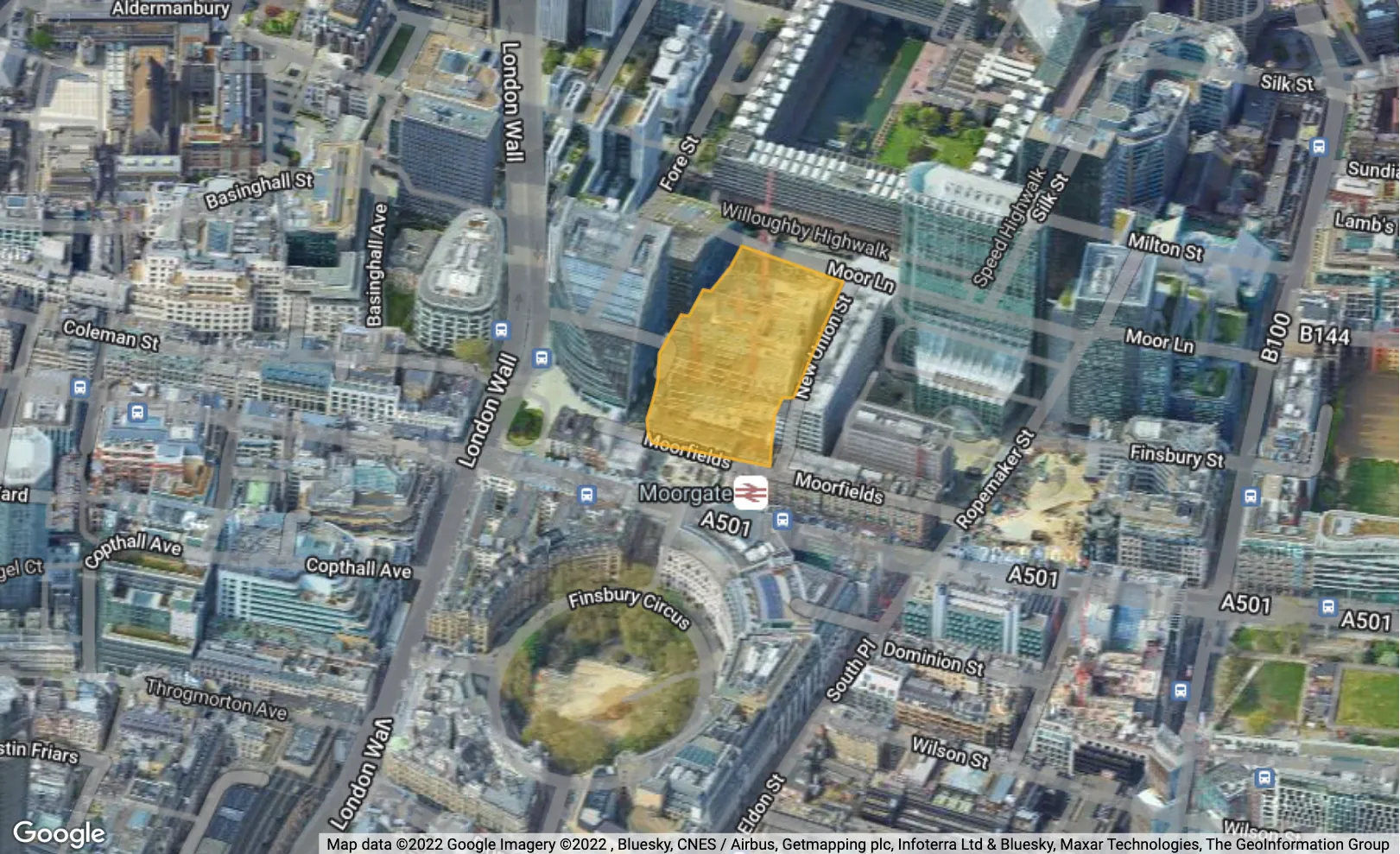

21 Moorfields is a commercial development on a 1,9-hectare site in the City of London north of London Wall and west of Finsbury Circus.

Deutsche Bank will occupy whole building of 564,000 sq ft on a 25-year FRI lease.

History

2017 August - Landsec and Deutsche Bank exchange a pre-let agreement on a 25-year lease. Deutsche Bank will move here from Winchester House.

2017 March - Deutsche Bank agrees to a 25-year lease.

October 2018 - Completion of the frame.

October 2017 - Planning submitted to provide a 564,000 sq ft building with trading floors, a gym and a highly resilient and flexible services infrastructure. In August 2017 the demolition finished and piling started.

in August 2017.

December 2016 - Completion of demolition by Keltbray.

Get exclusive 21 Moorfields updates on your email

Site & Location

The development is sat above the Liverpool Street Crossrail Station. The site is bounded By Moorfields, Fore Street Avenue, Moor Lane & New Union Street. 21 Moorfields is situated directly above Moorgate underground station and the western entrance to the Liverpool Street Crossrail station. Neighbouring buildings include Citypoint, Moorgate Exchange, London Wall Place and Andrewes House in the Barbican Estate.

Team

News from the companies

Nearby new developments

Disclaimer

Information on this page is for guidance only and remains subject to change. Buildington does not sell or let this property. For more information about this property please register your interest on the original website or get in touch with the Connected Companies.