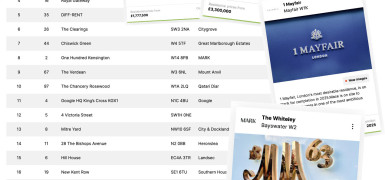

20 St Andrew Street

Key Details

Overview

20 St Andrew Street is an office building in London EC4.

Redeveloped in 2017, the building offers 9 floors of office space totalling nearly 52,000 sq ft with terraces from 6th floor up. Designed by DLA Design.

History

The old St Andrews House was ca a 50,000 square feet office building in London leased to Pricewaterhouse Coopers at £1.75 million per annum until 2013. The property was acquired from Cushman Wakefield Investors in October 2006. Planning consent has recently been obtained to add a new ninth floor to the building with spectacular views over the City. The property was sold to West Midlands Pension Fund in September 2011.

2011 - lettings by Kinney Green.

Neighbouring Buildings

66 Shoe Lane to north

References: Draco www.dracoproperty.com

Site & Location

Transport

NATIONAL-RAIL

BUS

Team

News from the companies

Nearby new developments

Disclaimer

Information on this page is for guidance only and remains subject to change. Buildington does not sell or let this property. For more information about this property please register your interest on the original website or get in touch with the Connected Companies.