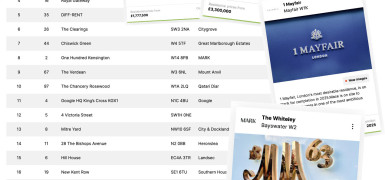

Two Kingdom Street

Key Details

Overview

Two Kingdom Street, the joint venture between Development Securities, Aviva Investors and Avestus Capital Partners, completed in February 2010, and delivered 235,000 sq ft of top specification commercial office space.

British Land acquired the building in Summer 2013.

Tenants:

- Kaspersky Labs- 16,626 sq ft first floor - 10 year lease from 2013;

- AstraZeneca global pharmaceutical company 75,000 sq ft from 2010;

- Rio Tinto, the leading international mining group - 6th floor 26,000 sq ft from Spring 2011;

- Nokia, global leader in mobile communications 58,366 sq ft at Two Kingdom Street, Paddington Central from Spring 2012.

Source: paddingtoncentral.co.uk

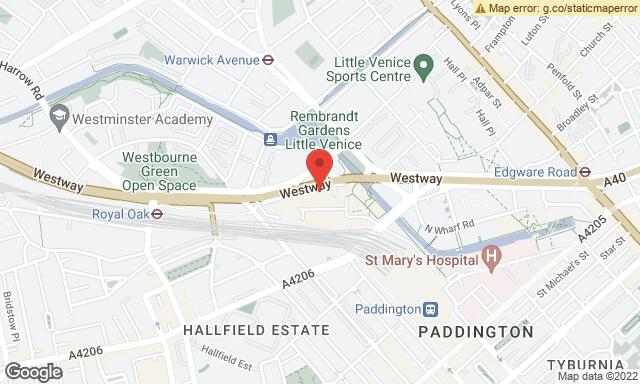

Site & Location

Transport

TUBE

BUS

Team

News from the companies

Nearby new developments

Disclaimer

Information on this page is for guidance only and remains subject to change. Buildington does not sell or let this property. For more information about this property please register your interest on the original website or get in touch with the Connected Companies.