One Threadneedle Street

Key Details

Overview

One Threadneedle Street is a Grade A office space over 7 floors 48,575 sq ft in the City of London.

Specification:

- 4 pipe fan coil heating and cooling system to

perimeter areas

- 2 pipe fan coil cooling system to internal areas

- Fully accessible metal tiled suspended ceiling

- In the spirit of LG7 lighting

- 150mm Fully accessible raised access floor

- 2.65m Floor to ceiling height

- 1.2m Planning grid

- New high performance glazing throughout

- Revised facade configuration

- Three new 13 person passenger lifts

- One new goods/cycle lift

- New standby generator

- New core and reception configuration

A BREEAM rating of 'Very Good' is to be achieved under the BREEAM Offices 2008 scheme.

The following environmental benefits have been realised:

- Cycle storage facilities and showers provided

- Energy and water sub-metering per floor

- Water consumption minimising technology including leakage detection and sanitary supply shut off

- Low VOC (Volatile Organic Compound) finishes used throughout (paints, varnishes)

- Specification of materials and suppliers to minimise any potential negative effects on the environment, taking reference from the BRE 'Green Guide to Specification'.

- Recyclable waste storage area provided in the basement

- Over 75% of weight of non-hazardous construction waste will be diverted from landfill

- Building management system

Source: www.onethreadneedle.com Summer 2012

Site & Location

Transport

DLR

BUS

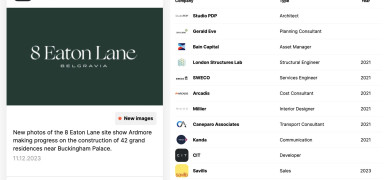

News from the companies

Nearby new developments

Disclaimer

Information on this page is for guidance only and remains subject to change. Buildington does not sell or let this property. For more information about this property please register your interest on the original website or get in touch with the Connected Companies.