Grain House

Key Details

Overview

Grain House is a mixed-use development in Covent Garden, London WC2.

The development includes the addition of a two-story roof extension across the whole site, with flexible office floorplates ranging from 6,222 sq ft to 15,791 sq ft arranged around an atrium with character finishes including exposed concrete, steel and brickwork.

The building will provide extensive external terracing and has been designed to achieve BREEAM ‘Excellent’, WELL Building’ accreditation as well as enhanced digital connectivity standards with ‘WiredScore’.

The site comprises four buildings:

- 26-29 Drury Lane;

- 30-35 Drury Lane / 2 Dryden Street;

- 4-10 Dryden Street; and

- 12 Dryden Street.

History

2019 - Planning permission granted for the removal of existing third and fourth-floor levels and roof top structures and partial demolition of Shelton Street elevation (third floor only); construction of new floorspace and internal reconfiguration resulting in a part five and part six-storey building with roof top plant enclosure, to provide flexible commercial use including retail (Class A1), financial and professional services (class A2) restaurant (class A3), office (class B1) and /or assembly and leisure (class D2) at basement and ground floor level and office use (Class B1) at first to fifth-floor levels; refurbishment of external elevations; roof terraces, plant, cycle parking and facilities for access and servicing. Architect Barr Gazetas. Westminster Council ref. no. 18/07715/FULL.

2020 March - Hines acquires Grain House on Drury Lane from corporate pension fund clients of Savills Investment Management.

Neighbouring Buildings

The building is situated across the road from Gillian Lynne Theatre.

Get exclusive Grain House updates on your email

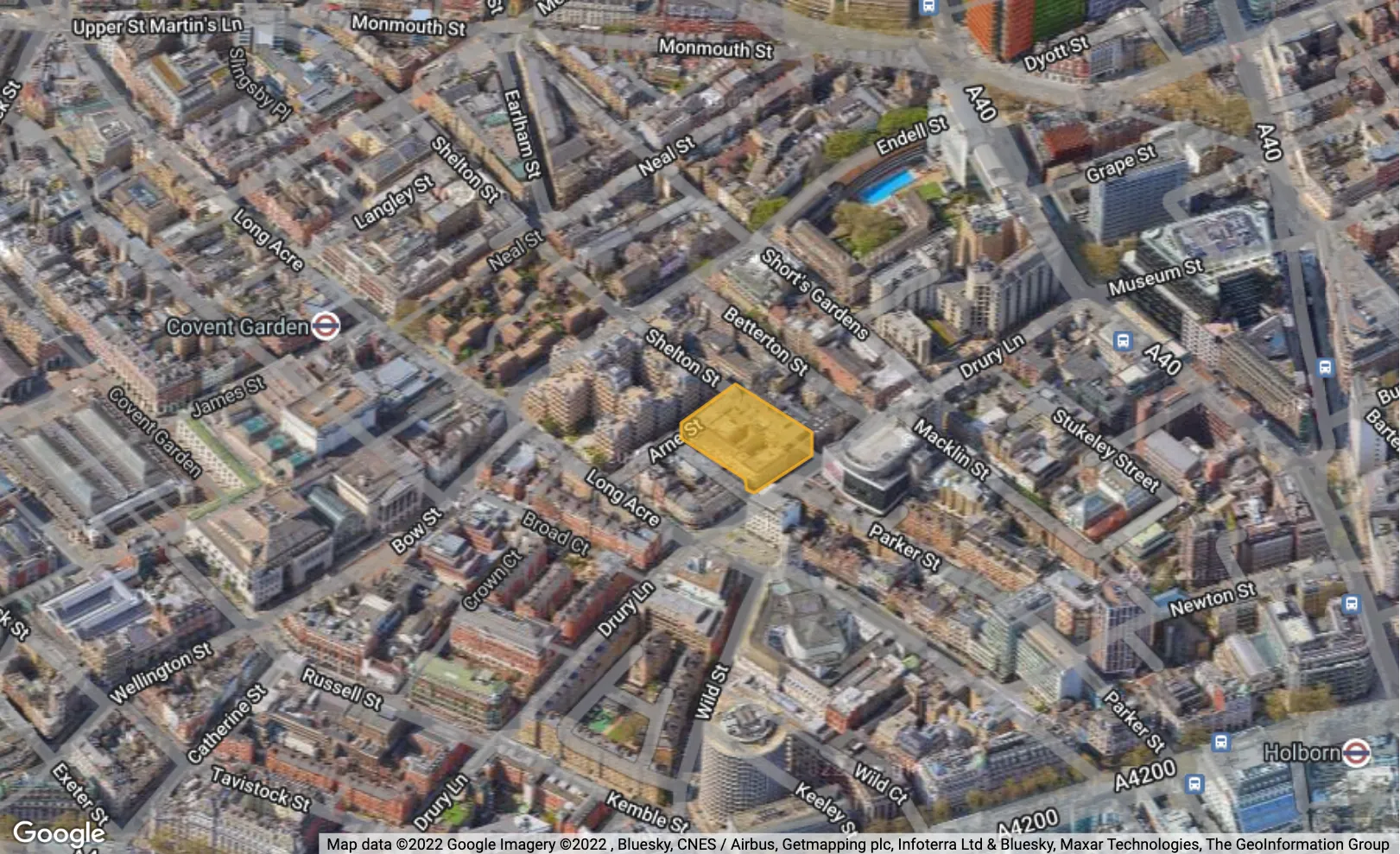

Site & Location

Neighbouring buildings include Gillian Lynne Theatre on Drury Lane and The Acre office development.

Transport

TUBE

BUS

Team

News from the companies

Nearby new developments

Disclaimer

Information on this page is for guidance only and remains subject to change. Buildington does not sell or let this property. For more information about this property please register your interest on the original website or get in touch with the Connected Companies.